All Things Payments

A whistle-stop tour of some of the emerging innovations in payments including Open Banking, Crypto, CBDCs, FedNow, and BNPL.

Welcome back, to Fintech Weekly.

It has been an interesting week, Elon Musk has either made a significant step toward creating the world’s next major Super App, or else he has revealed himself as a serious digital hoarder as the owner of Twitter has excercised his ownership of the domain name ‘x.com’, which he purchased during his PayPal days and how now used to rebrand the social media platform on a whim (read more on the story from The Verge). Barbenheimer lived up to the hype, smashing the expected revenue on its opening weekend. Oppenheimer director Christopher Nolan took the opportunity to reference the parallels between the creation of the atomic bomb and the development of AI, noting that it is crucial to have accountability for the actions of those at the forefront of this wave of technological development (read more on the story from The Verge). Also, Sam Altman officially launched his eyeball-scanning Worldcoin project (TechCrunch).

This week I wanted to change the structure of the newsletter slightly. Rather than jumping between an array of different topics from different disciplines, I want to focus on a central theme and explore a series of tangents around it. This week’s theme is Payments. With the increasing financialisation of almost all products and services we interact with, payments are more prominent than ever in our daily lives. Payments is a rapidly evolving space so this issue will be by no mean comprehensive, we have touched on several of these topics in previous issues of this newsletter and I fully expect to cover them again in the future, in this issue we will look to answer the following questions:

How was FedNow reviewed in it’s first week?

What happened to the Digital Dollar?

Where are CBDCs being implemented?

Why are card networks still needed for payments?

Who can I send crypto to on Beam?

When will you make your first purchase on TikTok?

How was FedNow reviewed in its first week?

FedNow was officially launched in the US last week, for a more detailed overview of the system, check out this previous issue where we covered the topic and the potential use cases it promises to support. For many in the industry it felt long overdue that the US caught up to speed in the world of instant payments, Japan have had instant payments since 1973, and more recently economies including India and Brazil have set the standard with the success of UPI and Pix respectively. Again, for more context on the success of Pix in Brazil, check out this previous issue.

Despite the hype and promise in the lead up to the release of FedNow I must say that there was a lot of pessimism in reaction to it’s first week on the job. Some pointed to the network effects that it is going to have to overcome to have real success in the market. It appears that a mere 42% of credit unions expect to offer real-time payments by the end of this year while nearly a quarter of financial institutions are not sure if they will ever adopt it. Furthermore, as a bilateral system, FedNow needs a balance of receivers and senders to function correctly and as things stand, the scales are tilted too much on the receiving side.

Another deterrent to the adoption of FedNow could be the price. TechCrunch reported that the Fed will charge banks 4 cent for a FedNow payment, 3.5 cents more expensive than ACH. Banks are free to decide how to pass this additional cost on to their customers and this choice could be crucial in determining the long term adoption of the system. Ironically, there is also a valid concern that instant payments are too fast. The argument is that instant payments can also lead to instant fraud. Unlike traditional payments which take some time to clear and settle, which provides a window for fraud teams to review and reverse a payment, instant payments settle in near real time, thus finalising fraudulent payments before you have a chance to react. While this may be daunting at first, there is sure to be innovative solutions to come to improve the security of payment system that facilitate FedNow.

Sources:

Read the full article on TechCrunch, Coindesk, TechCrunch, Forbes, Forbes

What happened to the Digital Dollar?

The release of FedNow also reminds us of another highly anticipated, yet far more controversial innovation to the US payment system, the Digital Dollar. The Fed were quick to deny speculation that FedNow was a precursor to the launch of a CBDC (see Coindesk). Back in 2020 during the height of the crypto hype cycle, the Federal Reserve announced a collaborative project with MIT to work on Project Hamilton, which would explore the use case of a Central Bank Digital Currency in the US. At the time, this was a very topical subject with China launching their Digital Yuan project (more on this below), and even Meta announcing plans for their project Libra.

The Digital Dollar has now become a political debate ahead of the next US Presidential election, with Republican candidate Ron DeSantis stating that he will make sure to block any attempts to implement what he sees as a government surveillance operation that would encroach on civil liberties.

To be clear, Project Hamilton was set out as a research project with the goal of answering questions like if a CBDC could facilitate the transaction volume required to support the US economy. From this perspective the project had incredible success, demonstrating a system in 2022 that could facilitate 1.7 million transactions per second versus the 65,000 that Visa’s network can support. The Project Hamilton team approached the research with a technology-agnostic perspective, this gave them freedom to pick and choose design components, for instance they took inspiration from the Bitcoin network but ditched the elements of decentralising and Byzantine Fault Tolerance as they felt it could be assumed that a Central Bank would act in good faith.

However the future of the Digital Dollar is looking less likely as Project Hamilton was axed after pressure from anti-CBDC legislators in 2022. Despite repeated statements that Project Hamilton was a research endeavour it did not escape the fury of those opposed to CBDCs. The Fed is containing it’s research into the ongoing development of CBDCs, this is prudent given BIS reported that 24 Central Banks plan to have a CBDC operational by 2030 (more here). The Fed has also assured the public that it would not implement a CBDC solution without legal authorisation, given the current political reaction we can assume that a spectacular mood change would be required to regenerate Project Hamilton or a similar endeavour.

Sources:

Read more on the story in MIT

If you are enjoying the content so far, please take a moment to share the newsletter, it really helps me grow the platform and find new readers.

Where are CBDCs being implemented?

Meanwhile, two economies that are making concrete steps in their CBDC programs are Russia and China. This week Vladimir Putin signed a bill that was sanctioned by the Duma only weeks prior to implement a Digital Rubel. The project plans to keep its momentum going as it is reported to be set for a go-live date some time next month!

As for China, they have restated their position as the most advanced CBDC project this week. The central bank governor Yi Gang, was spreading at a lecture organised by the Monetary Authority of Singapore this week and announced that transactions using China's digital yuan hit 1.8 trillion yuan ($249.33 billion) as of June, representing a jump from over 100 billion yuan as of August last year. Yi reported that Total e-CNY transactions reached 950 million, with 120 million wallets being opened. So far the e-CNY has been primarily used for retail transactions. While the growth numbers may look impressive, in context they still represent a fraction of the overall market. e-CNY in circulation accounted for only 0.16% of China's money supply. As discussed in previous weeks issues, private payment solutions like Alipay have dominated the Chinese market in recent years.

Sources:

Read more on the story on Blockworks and Reuters.

Open Banking Payments

Anyone who has worked in the payments space will know that card network costs can really accumulate and eat into your profits. Open Banking payments offer a solution to this, allowing customers to pay directly from their banks. This week TrueLayer announced the launch of their Payment Links product which looks to optimise the payment flow and allow business to accept payments from anywhere, that settle instantly, through a simple link.

The solution is advertised as being straightforward to integrate via the TrueLayer API and enables business to generate a payment link or QR code for their products. This has multiple advantages for business, first, costs will be reduced as discussed above as they bypass the card networks, second security it built in as bank authentication is required at each stage of the payment, and third, conversion can be improved as payments can be generated at any stage of the user journey, including via chat as the customer researches a product, on social media, in person, or even in follow up emails if a customer has abandoned a payment at the checkout stage.

Sources:

Read more on the story on The Paypers

Who can I send crypto to on Beam?

It wouldn’t be a payments newsletter without talking about some crypto-enabled innovations, and this week I was intrigued to hear about Beam, a p2p crypto transfer service that has stated their objective to become a ‘global Venmo’. Eco.inc is the company behind the product, they are backed by the likes of a16z and have so far raised approximately $95 Million according to Crunchbase.

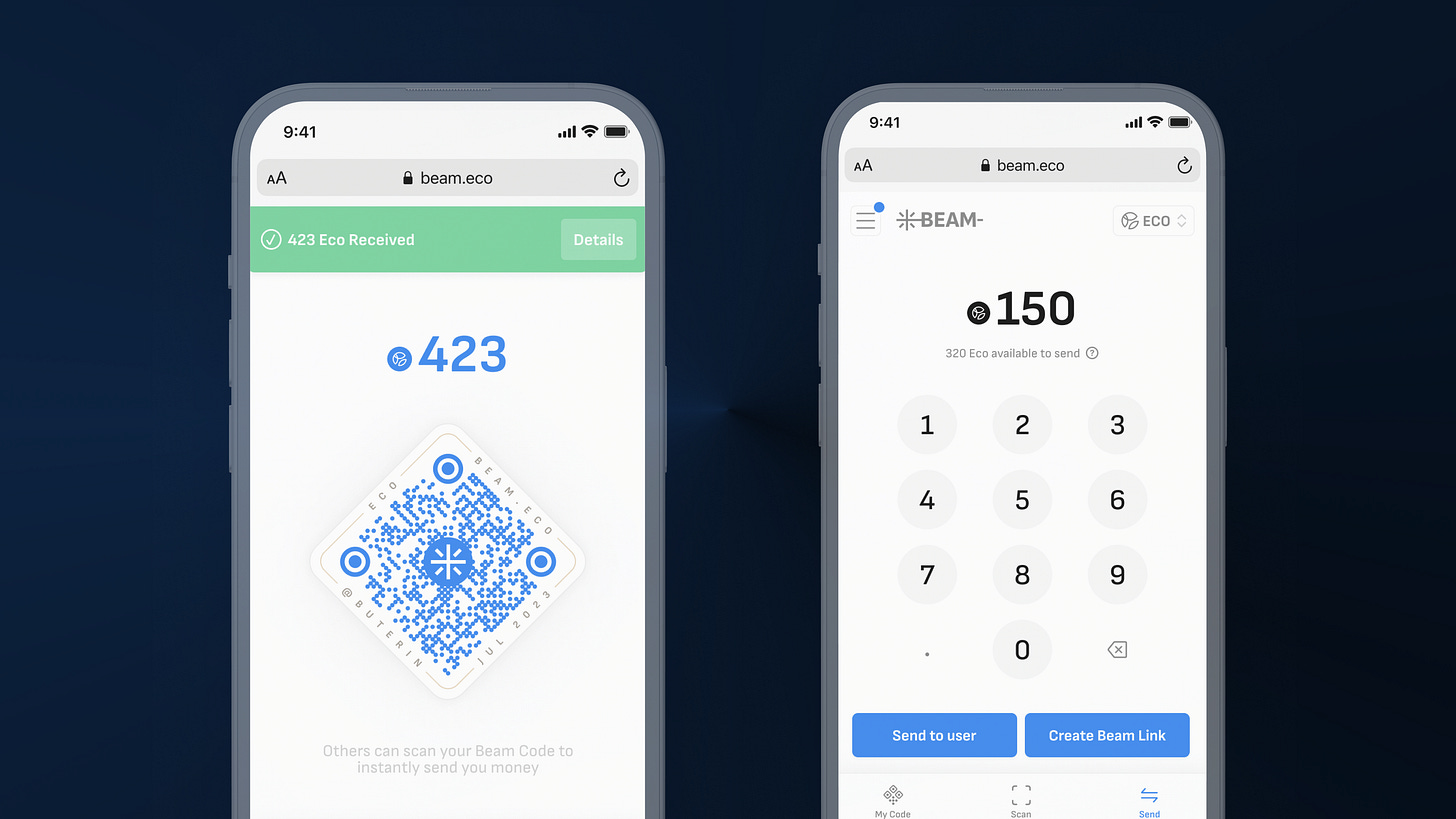

To use the service, Beam users simply visit the wallet website and a QR code linked to a wallet address can be automatically generated. Users can transfer USDC from their wallets or use the popular on-ramp service, Moonpay, to convert fiat into crypto. The really clever part is that when sending funds, the second party does not need to have a crypto wallet already set up as users can share a wallet URL that contains the cryptocurrencies. This is not only user friendly, but is also an excellent mechanism for incentivising new users to sign up, why wouldn’t you if there are funds waiting after registration?

This story caught my attention due to the way the product has been built. Beam implements some exciting innovations in the Ethereum protocol that have been discussed in previous issues this newsletter, primarily ‘Account Abstraction’, also known by its more technical name ERC-4337. I won’t get into the technical details of ERC-4337 because that is entirely the point of ERC-4337 - it removes the need for end users to be crypto savvy and instead allows them to simply focus on the benefits of the product. When we last discussed Account Abstraction we wrapped up by posing the question - “could we finally see the emergence of every-day web3 applications adopted by the masses?” It is exciting to see Beam emerge as one of the first practical use cases that take advantage of this improved user experience.

Sources:

Read more on the story on TechCrunch

TikTok e-Commerce and BNPL

Our final story this week concerns social media behemoth TikTok, as it was reported this week that they will launch an e-commerce store ‘TikTok Shop Shopping Centre’ (yes, you would have thought they would have put more time into the branding) in the US to sell made-in-china products to it’s American users. The social media platform is developing it’s e-commerce presence as it looks to store and ship produce from Chinese manufacturers to the US while also handling the marketing, transactions, logistics, and after sales services. While the e-commerce play is still in it’s infancy for TikTok, leveraging it’s billion global users as well as the ‘full service model’ it offers manufacturers is likely to be a significant draw.

While it may be a relatively new endeavour for the platform, TikTok Shop is not to be found wanting when it comes to industry trends, as it was reported that they have partnered with Atome to provide Buy Now, Pay Later services to Malaysian users. BNPL will allow users to spread the cost of their repayments over multiple instalments. We have discussed BNPL on the newsletter previously and while it has grown in popularity and certainly offers convenience and reduces friction at the point of checkout, I have expressed my concerns over the risk it poses to customers who may overspend in search of immediate gratification from making a purchase only to be burdened by future repayments.

Sources:

Read more on Wall Street Journal and CNBC

Payments is a constantly evolving and rapidly innovating area of Fintech. The declining use of physical options including cash and cheque has made way for the proliferation of digital solutions, initially card payments, but now even this is being disrupted by BNPL, instant payment rails, crypto solutions and Central Bank Digital Currencies. Also, the market for payment solutions has increased significantly, the improvements in finial inclusion facilitated by digital and mobile payment solutions was long overdue and certainly welcome, while the increasing financialisation of all products, including social media platforms may not have the same altruistic theme but it is no less disruptive.

Thanks for reading, as always, if you have any feedback or suggestions for topics I could cover in future newsletters please let me know by commenting through the link below.