Fintech Weekly #1

What is Ether? When will Open Banking be mainstream? Where are all the unicorns? Who is Boris Eldgasen? Why are N26 Struggling? How will Apple's Card Savings Account Work?

Hello, welcome, and thank you for taking the time to read the first-ever addition to this Fintech Weekly newsletter. Before I get into it, a bit of context.

First, if you want to know more about me and the motivation behind starting a newsletter, you can find the full explanation here on my substack.

Second, as this is all new to me, if you have any feedback or suggestions for topics I could cover in future newsletters please let me know by commenting through the link below. Any and all feedback would be greatly appreciated.

Without further ado, let’s get into this week’s newsletter.

What is Ether?

The short answer is that it is still undefined, at least in a regulatory sense.

While this may seem like a basic question to be asking almost 8 years after the cryptocurrency was launched in August 2015, the actual definition of Ether as an asset was shown to still be ambiguous this week. In a hard-to-watch exchange, Chairman of SEC Gary Gensler refused to define Ether as a security during a five-hour hearing before the House Financial Services Committee on Tuesday.

As the cryptocurrency and digital assets industry grows, there are further calls for clarity as to how these assets should be regulated. The context for all this is the recent collapse of FTX and the arrest of its founder Sam Bankman-Fried (read more here).

Meanwhile, on Thursday, the EU took definitive steps by approving the landmark Markets in Crypto Assets (MiCA) regulation for governing and safeguarding the crypto industry (full story here).

When will Open Banking be Mainstream?

Perhaps the 7 million + active users in the UK alone would argue that it already is mainstream. However, there is certainly still plenty of room for improvement in this field. This is supported by research carried out by Ecommpay that found only 14% of UK consumers fully understood the concept of Open Banking.

In an effort to address this, the Joint Regulatory Oversight Committee (JROC) published its recommendations for the next phase of Open Nanking in the UK. The objective of the roadmap items for the next two years is to enable Open Banking to develop further in a safe, scalable and economically sustainable way. The recommendations cover five themes:

levelling up availability and performance

mitigating the risks of financial crime

ensuring effective consumer protection if something goes wrong

improving information flows to third-party providers (TPPs) and end users

promoting additional services, using non-sweeping variable recurring payments (VRP) as a pilot

Open Banking has always had the potential to bring significant disruption to the fintech market and more importantly, bring value to customers, but progress and adoption have been slow and steady over recent years. Whether this will change in 2023 remains to be seen.

Where are all the Unicorns?

There was only one unicorn birth in the Fintech market in Q1 2023, the first time this has happened in a quarter since 2016. The lone wolf (ok, that’s enough animal references) was MNT-Halan, an Egyptian fintech, which “was created to digitally bank the unbanked and substitute cash with electronic solutions”.

This finding came from a CB Insights State of Fintech report which was published this week showing the market is not in the clear just yet, despite an increase in investment activity QoQ of 55% compared to Q4 2022.

The key highlights from the report were as follows:

Global fintech funding grows 55% QoQ in Q1’23; $6.5B is raised by Stripe alone.

Early-stage deal share reaches 72%, a new high.

Unicorn births fall to 1 for the first time since 2016.

Fintech M&A exits rebound, increasing 15% QoQ.

Banking funding and deals hit the lowest levels since Q2’17.

Who is Boris Eldgasen?

Boris Eldgasen is a 52-year-old German who won a Sony world photography award this week, only to later reveal that "Something about this doesn't feel right, does it?", and that the image has been AI-generated. Needless to say, this did not amuse the awarding body. The artist says that the motivation behind the “cheeky” stunt was to create a discussion about the future of photography (read the full story here).

Another creator that discussed the creative capacity of AI this week was YouTuber Casey Neistat. However, unlike Eldgasen, Nesitat argued that AI still lacks the “soul” of a true artist. His AI-generated vlog clearly lacked his trademark style.

While not strictly a Fintech topic, the blurring of the lines between AI and reality is a topic everyone is talking about and one that Fintech will not be immune from.

Why are N26 Struggling?

The Financial Times reported this week that poor strategic planning, leadership and governance were to blame for the struggles of N26, Germany’s most valuable Fintech.

This comes in light of Allianz announcing that it is willing to offload its stake in the Fintech for $3 Billion, a 68% discount compared to a 2021 valuation of $9 billion. Allianz is one of the largest external investors in N26, holding nearly 5%.

N26 is not the only Fintech feeling the effects of inflation, rising interest rates, and uncertainty in the economy. For example, Klarna, the Swedish Buy Now Pay Later provider secured a €6.7 billion valuation after their €800 million raise last July. This represented an 80 per cent drop compared to their last round.

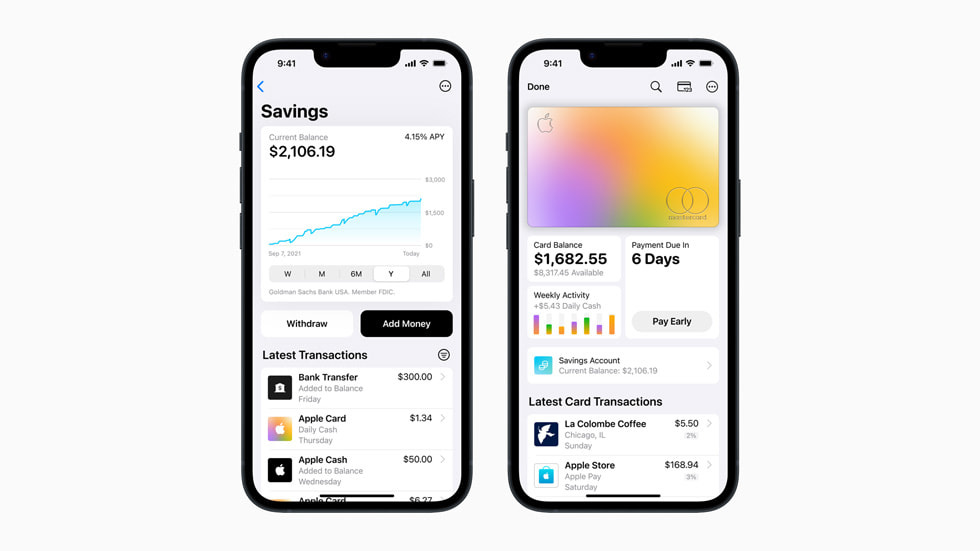

How will Apple’s Card Savings Account Work?

Apple has partnered with Goldman Sachs to offer US Apple Card customers the option to open a savings account and earn interest at an APY of 4.15%. Apple Card customers will get cash back on all purchases paid with Apple Card.

Once set up, customers receive cash rewards every day in Apple’s Daily Cash. There are no fees, no minimum deposits, and no minimum balance requirements associated with the savings account.

In order to open and maintain an account you will need to meet the following criteria:

Be an owner or co-owner of an active Apple Card account and add Apple Card to your iPhone.

Be at least 18 years or older.

Have a social security number or individual taxpayer identification number.

Be a U.S. resident with a valid, physical U.S. address.7

Set up two-factor authentication for your Apple ID and update to the latest version of iOS.

Massive congratulations Kevin. Absolutely loved ever single read. It was very engaging and captivating. Would love you to cover topics which are close to heart. And even about the climate change, coast of living and inflation. I’m very much looking forward reading further newsletters. Well done. You should be very proud.