Australia is in no rush to implement a CBDC

BIS Report on Crypto Assets, Mastercard and RBA weigh in on CBDCs, SWIFT's payment innovations, dLocal versus Adyen, and Ramp are ramping up.

Welcome back, to Fintech Weekly.

The jig is up! Reuters has clearly been reading Fintech Weekly, this week they also discussed the potential of PayPal to learn from the mistakes of Facebook in launching a stablecoin. If you missed the Fintech Weekly Original take on this topic from a few weeks back, check it out here. To follow up on another story we covered a few weeks back, AliPay launched its latest version of the app which will be available for international users last week, the full story is here.

How have crypto assets amplified financial risks in less developed economies?

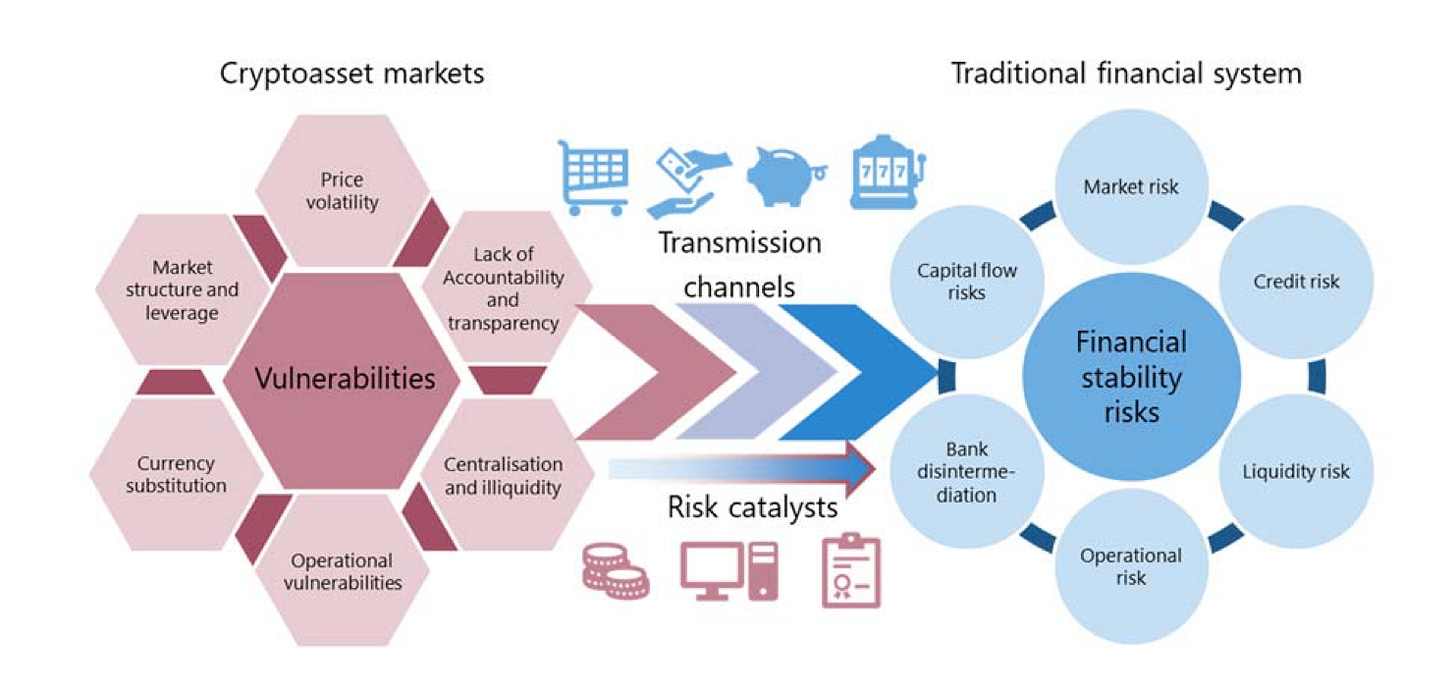

This week, the Bank of International Settlements published a report on Financial stability risks from cryptoassets in emerging market economies. The headline finding from the report is that the adoption of crypto assets has amplified rather than reduced financial risks in less developed economies, and regulators will need to treat them in the same way they oversee other assets.

The report discusses the evolving landscape of digital finance and the rapid growth of crypto assets in-depth, focusing on emerging market economies (EMEs). The motivation for focusing in particular on EMEs was due to their financial market characteristics such as limited access to investment and savings instruments (insofar as most have bank-based financial systems), relatively low financial literacy and more volatile domestic financial conditions, these factors contribute to making EMEs more vulnerable to crypto-related financial stability risks compared to Advanced Economies.

Crypto assets have been more intensively adopted in EMEs than in AEs. According to the 2022 Global Crypto Adoption Index, 18 of the top 20 positions correspond to EMEs. EMEs are drawn to crypto assets due to the need to store value due to high inflation or high currency depreciation, the need by migrants to transfer money back to their countries (remittances) and also, in some countries, the search for yield.

BIS identify six financial stability risks in traditional financial markets from exposure to crypto-asset markets:

Market Risk - the risk of losses arising from movements in market prices due to events in cryptoasset markets.

Liquidity Risk - the risk of incurring losses resulting from the inability to meet payment obligations in a timely manner when they become due or without incurring unacceptable losses.

Credit Risk - potential that a counterparty in crypto asset markets or directly exposed to crypto assets will fail to meet its obligations in accordance with agreed terms.

Operational Risk - the risk of loss resulting from inadequate or failed internal processes and systems, human errors or external events.

Bank Disintermediation Risk - the risk that individuals and firms withdraw their deposit funds from traditional financial institutions and transfer them to other institutions.

Capital Flow Risk - the potential for large and sudden changes in the flow of capital between countries due to the buying and selling of crypto assets.

This report finds three main catalysts that can amplify the financial stability risks of crypto assets in EMEs;

The economic, financial and institutional landscapes;

The degree of technological infrastructure and knowledge;

The regulatory stance.

The report concludes that crypto assets have largely been pitched as a silver bullet to the financial challenges faced in EMEs, offering a low-cost payment solution and an alternative to domestic currencies which are susceptible to high inflation or high exchange rate volatility. Unfortunately, this has not come to light and cryptoassets have so far not reduced but rather amplified the financial risks in less developed economies. In an attempt to wrap up on a more optimistic note, the report emphasizes that hope remains for crypto assets to fulfil their promise, and the challenge is to establish a regulatory framework to channel innovation into such socially useful directions.

Sources:

Read more on this story from The Bank of International Settlements and Financial Times

If you are enjoying the content so far, please take a moment to share the newsletter, it really helps me grow the platform and find new readers.

In Other News:

Who is part of Mastercard’s CBDC Partner Program?

Payments giant Mastercard is also weighing in on Central Bank Digital Currencies by establishing a CBDC Partner Program, a group of leading blockchain technology and payment service providers to develop a shared understanding of “the benefits and limitations of CBDCs and how to implement them in a way that is safe, seamless and useful”. The group includes Ripple, Consensys, Fluency, Idemia, Fireblocks, Consult Hyperion and G+D. As discussed in last week’s newsletter, the demand for cash is still very much alive as many have concerns over the privacy and security of digital payments and CBDCs, therefore many Central Banks are taking a cautious approach to implementation, hoping to get it right rather than just getting it first.

Sources:

Read more on the story in CoinDesk and Mastercard

Where has dLocal’s growth come from compared to Adyen?

Last week, TechCrunch reported on the contrasting performances of Uruguayan Fintech dLocal and Dutch Fintech Adyen. The former saw their stock rise by 30% after news that they appointed Pedro Arnt as their new co-CEO and reports that revenue is up 59% YoY and 17% QoQ. Meanwhile, the latter saw their shares sink to the lowest levels in three years, while revenue was up 21%, YoY it was lower than analysts’ expectations. Interestingly, the differing fortunes of the two Fintechs appear to be influenced by their strategies for market expansion. While Adyen focused on North America, dLocal has come to the conclusion that many others seem to be reaching recently (as discussed in recent newsletters) that North America is overserved, and the real growth opportunities are in Latin America and Africa.

Sources:

Read more on TechCrunch, CNBC

Why has Ramp’s valuation fell after raising $300 Million?

US-Fintech Ramp has raised $300 Million to fuel its expansion. The company was named the most innovative finance company in the world by Fast Company in 2022 and specialises in spend management. To date they raised multiple rounds of investment from backers including Stripe, and the latest round was co-led by existing backer Thrive Capital and new investor Sands Capital. This round values Ramp at a post-money valuation of $5.8 billion, down significantly from the $8.1 Billion valuation after their previous $750 million raise. Ramp CEO Eric Glyman claims the company has grown in the interim to serve five times as many companies and attributes the decline in valuation to the broader start-up market climate and cost of capital compared to 2021, a factor that Stripe themselves can attest to having suffered declines in valuation themselves.

Sources:

Read more on Silicon Republic and TechCrunch

When will Australia implement a CBDC?

The answer to that question appears to be not anytime soon. The Reserve Bank of Australia is the latest Central Bank to weigh in with their take on Central Bank Digital Currencies, as they published a detailed report on the results of a five-month pilot program into an eAUD. The primary objective of the pilot was to identify potential areas where the eAUD could positively impact the Australian economy with a focus on four main areas, including enabling complex payments and asset tokenization. The pilot garnered interest and participation from banks and Fintechs alike who combined to submit 110 potential use cases. The program identified advantages of a potential CBDC including atomic settlement, programmable payments, and the potential to establish new markets for tokenized assets. However, it seems the conclusion of the pilot is that currently, the market is not ripe for the implementation and adoption of a CBDC, largely due to factors including regulatory compliance and the practicalities of crypto key management.

Sources:

Read more on the story on Decrypt, and the full report from the RBA

What innovations are SWIFT working on?

Regarding payments, speed is a key metric, the days of counting settlement times in days rather than seconds are no longer acceptable. In recent weeks we have discussed the ambitions of new disruptors to the market that look to innovate in the payments sector, as well as the implementation of instant payments systems like FedNow in the US. However, the global messaging platform, SWIFT, is not eager to go down without a fight. This week the platform announced that 89% of the cross-border payments made via its service are being processed within an hour, ahead of schedule for the the G20’s Financial Stability Board’s goal, which aimed for 75% of international transactions to go through in an hour by 2027. SWIFT is doing what it can to keep pace with emerging technologies. In July, SWIFT joined forces with settlement firm Iberpay and Spanish banks including BBVA, and Santander and announced that it had successfully completed a pilot to process instant payments across currencies. Additionally, earlier in the summer, they announced that the platform is currently testing existing infrastructure to transfer tokenized value over blockchain networks.

Sources:

Read more on the story on Pymnts

Thanks for reading, as always, if you have any feedback or suggestions for topics I could cover in future newsletters please let me know by commenting through the link below.